how to file back taxes without records canada

If you need wage and income information to help prepare a past due return complete Form 4506-T. To do so visit the CRA My Account page and log in.

Tax Season Shredding What To Keep How Long Shred Nations

These are the 2018.

. They will take your previous five years income since you last filed and use that to estimate what your next five years income will be and. I moved to Canada in 2010 and have no idea how to file taxes. If the status of your tax return is listed as not received it means that the CRA has not officially received your tax return.

How far back can you go to file taxes in Canada. Its easiest to pay every month to avoid a. Ensure to complete and get your client to sign a Form T183 Information Return for Electronic Filing of an Individuals.

Step 2 If you cant find the information youre looking for make an access to information or personal information. This means that if there were several years where you did not file your taxes or did not file your taxes correctly you need to submit information on all of these years. Every time your employer or payer issues you a tax slip a copy is sent to Canada Revenue Agency CRA which means you can simply request copies for past years from CRA.

It is a failure to do. Thats just for the first. The longer you go without filing.

This method is usually the fastest way to get the information. Prepare the tax return from the clients documents. The experienced Chartered Professional.

Embarrassingly I didnt file my taxes for the last few years. For more information including. You must have the.

According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return. The penalty for filing taxes late is 5 of the tax years balance owing plus 1 of the balance owing for each full month your return is late up to a maximum of 12 months. The first step is gathering any information from the.

Youre required to file a tax return in the year you leave Canada if you have a tax balance owing or youd like to receive a tax refund. Contact Us by Email or call 1 855 TAX DOCS 1-855-829-3627 for a free no obligation consultation regarding all your back tax filing needs. You get immediate confirmation that we have received.

If you are uncertain check with CRA or an accountant. All of your claimed business expenses on your income tax return need to be supported with original documents such as. Its only illegal when you receive a request to file or youre taxable and you dont file.

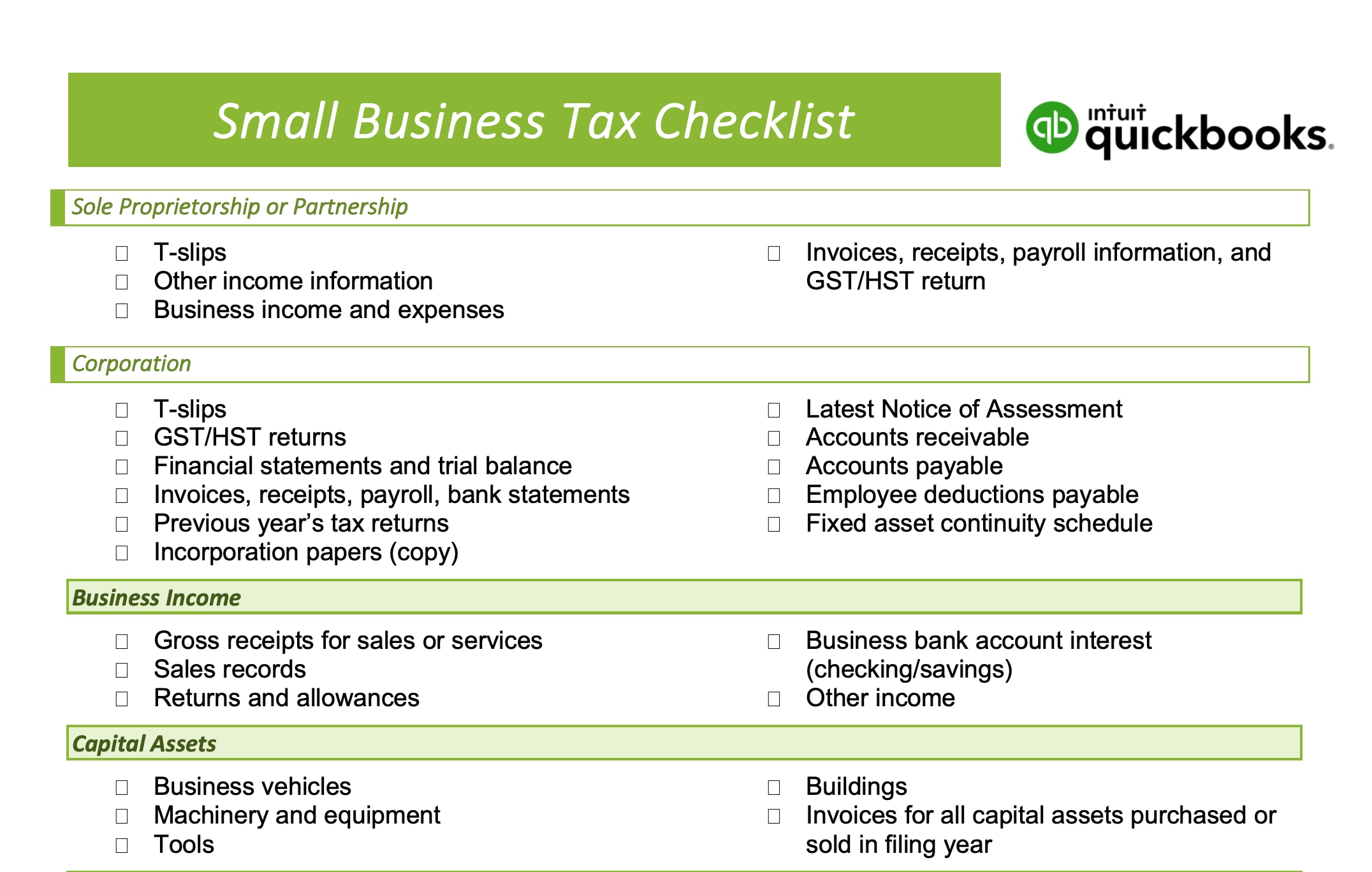

However this is only the. If you have not filed a GSTHST return for a reporting period that ended more. For personal returns you will need any and all T-slips such as T4s and T5s.

For example a 2015 return and its supporting. To File or Not File a Tax Return. This an affordable option to hiring a tax accountant.

If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due date. The Canada Revenue Agency CRA has detailed information for situations where your records including those of your business are affected by a disaster. If you filed your tax return after the filing deadline CRA charges a late-filing fee.

Filing a tax return for a previous year isnt as hard as you may think but it does require a few steps. If you are missing any slips or are unsure if you have them all you. However to properly use tax accounting software and learn how to file back taxes without records.

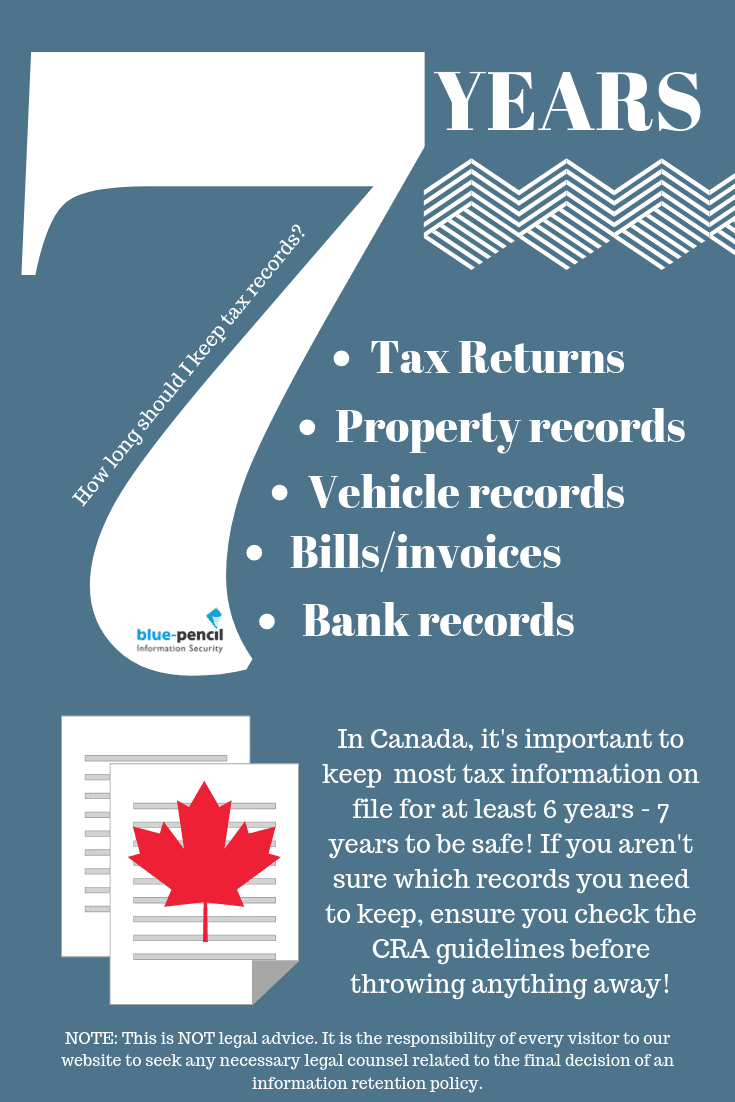

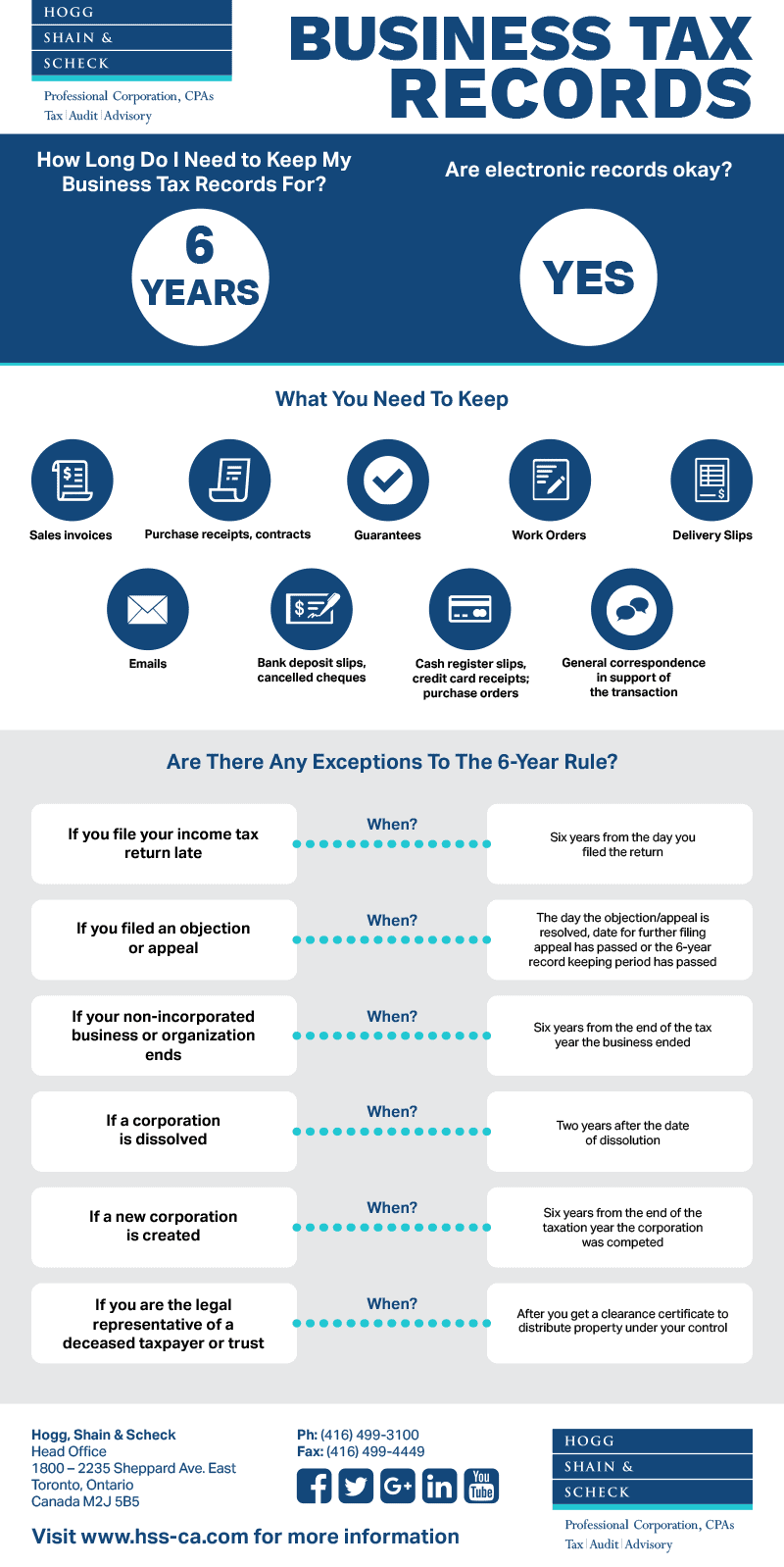

If you file an income tax return late you must keep your records for six years from the date you file that return. The rule for retaining tax returns and documents supporting the return is six years from the end of the tax year to which they apply. You cant file a return.

Its called notional assessment. Generally you cant make tax claims without receipts. Below are actionable steps you can take to avoid joining issues with the CRA.

Bonus was that we didnt have to wait for an income tax return cheque in the mail because if we set up direct deposit the CRA would send it to use directly. For filing help call 1-800-829-1040 or 1-800-829-4059 for TTYTDD. For 2019 this penalty is 5 of the balance owing plus 1 for every month you were late to a.

You can file your tax returns directly through a NETFILE-certified tax software which is more accurate with fewer chances of errors. If youre self-employed youre responsible for deducting your income tax.

How Long To Keep Tax Records Business Documents Blue Pencil

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Here S How Long You Should Keep Your Tax Records Forbes Advisor

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

Trump Paid 750 In Federal Income Taxes In 2017 Here S The Math The New York Times

Tax Season Shredding What To Keep How Long Shred Nations

Tax Records How Long To Keep Them To Be Safe

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Tax Checklist For Canadians Tax Checklist Business Tax Financial Checklist

How Long To Keep Tax Records In Canada Why

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

Trump Paid 750 In Federal Income Taxes In 2017 Here S The Math The New York Times

Mak Financials Audit Services Business Tax Retirement Strategies

Payroll Records What To Keep How Long To Keep Them

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

When Is It Safe To Recycle Old Tax Records And Tax Returns

How To File Small Business Taxes Quickbooks Canada

How Long Do I Need To Keep My Business Tax Records For Are Electronic Records Okay What You Need To Keep Are There Any Excepti

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Income Tax Return Income Tax How To Get Money